As a leading mutual fund provider, we are committed to helping you achieve your financial goals through personalized investment strategies, expert guidance, and a diversified range of mutual fund options.

I am a SEBI-certified mutual fund distributor passionate about helping individuals secure their financial futures. Since starting my career at 18, I’ve guided over 9,000 clients toward smart investment decisions, earning recognition, trust, and accolades, including Million Dollar Round Table (MDRT) membership and the prestigious Court of the Table honor.

Inspired by my father, Mr. H.K. Pandey, a legend with 35+ years in the industry and 28 consecutive MDRT memberships, I carry forward his legacy of excellence and dedication. My mission is to educate and empower people about investments, the cornerstone of financial security and freedom.

With a deep commitment to transparency and professionalism, I strive to make a lasting difference in people’s lives. Let’s build a financially strong future together.

With a robust suite of products ranging from digital banking and payment processing to wealth management and blockchain applications we empower our clients

No Fees, Ever!

No Fees, Ever!

Invest in Mutual Funds in India with TRIUMPH Mutual Fund Distributors - For a Lifetime!

Explore the Best Funds

Explore the Best Funds

Explore and invest in top-rated mutual funds with consistent performance

Comprehensive Portfolio Insights

Comprehensive Portfolio Insights

Access Smart Insights on Your Mutual Fund Investments – Free of Charge

Manage SIPs like a Pro

Manage SIPs like a Pro

Set up AutoPay or invest instantly with 1-Tap Top-up anytime you wish.

WHY TO INVEST IN MUTUAL FUNDS BY TRIUMPH MUTUAL FUND DISTRIBUTOR

Offering a range of products, including payment processing, SIP, and investment solutions.

Get expert guidance to make informed financial decisions and secure your future.

Driving innovation in finance with cutting-edge solutions for a secure future.

With a robust suite of products ranging from digital banking and payment processing.

As a leading Mutual Fund Distributor, we offer a range of services designed to help you make smart investment decisions. Whether you're a seasoned investor or just starting, our platform provides tools, expert advice, and secure transactions to help you grow your wealth through mutual funds.

Quick Invest makes investing easier than ever. We provide tools for making investments via **SIP** (Systematic Investment Plans), **SWP** (Systematic Withdrwal Plans), and more, helping you invest in top-performing mutual funds with ease and confidence.

We provide personalized tax-saving solutions through **ELSS (Equity Linked Savings Schemes)** and other retirement planning options to help you minimize tax liability and secure your financial future. We guide you through the best options for long-term wealth creation and retirement planning.

We help you manage your mutual fund portfolio by continuously monitoring the performance, suggesting changes when necessary, and ensuring your investment strategy is aligned with your goals.

Knowing when to exit a fund or switch between funds is critical for maximizing returns. We provide expert guidance on identifying the right time to exit or switch, ensuring that your investments continue to perform well over time.

As a leading mutual fund provider, we are committed to helping you achieve your financial goals through personalized investment strategies, expert guidance, and a diversified range of mutual fund options.

Excepteur sint occaecat cupidatat non proident.

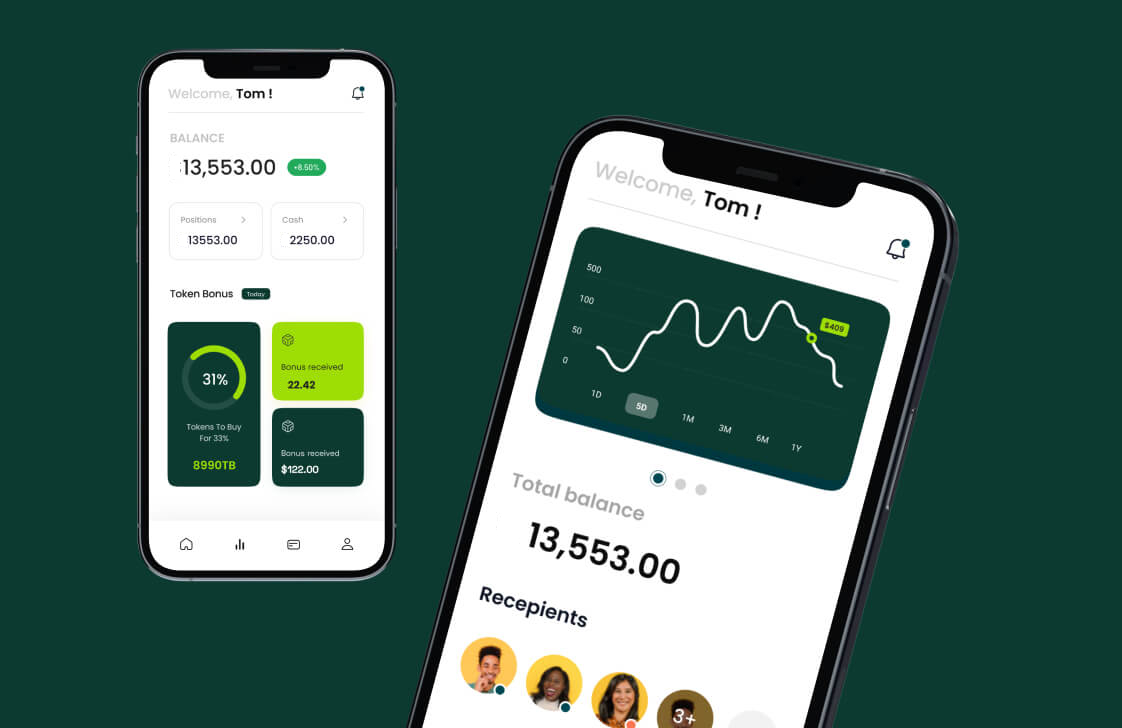

7 days report

Total balance

Assess the fund's historical performance and Assets Under Management (AUM) to ensure stability and growth potential.

Evaluate the track record of the Asset Management Company (AMC). A well-established AMC with a strong history suggests reliability and effective fund management.

Consider the experience and expertise of the fund managers. Experienced fund managers can make informed decisions that enhance the fund's performance

Compare the fund's returns with its benchmark index. Consistent outperformance indicates strong fund management.

By combining advanced technology with financial expertise, we offer a comprehensive range of services tailored to meet the needs of both individuals and businesses.

Our mission is to bridge the gap between traditional banking and modern financial solutions by providing innovative, seamless services that enhance the customer experience and meet the evolving needs of individuals and businesses in today’s world.

Begin by selecting a mutual fund that matches your investment goals, risk profile, and time horizon. Research different funds, considering their type, objectives, and performance history to find the one best suited for you

Review the fund's past performance, asset allocation, and management history. Compare the fund’s returns with relevant benchmarks to assess its consistency and ability to meet your financial objectives over time.

Once you've selected the right fund, decide whether to invest via a Systematic Investment Plan (SIP) for regular contributions, or make a lump sum investment for a one-time deposit, based on your financial goals

By integrating advanced technology with financial expertise we provide a comprehensive suite of services that cater to both individuals and businesses

A Systematic Investment Plan (SIP) enables you to invest a fixed amount regularly in a mutual fund, fostering disciplined saving and long-term wealth growth

A Systematic Withdrawal Plan (SWP) allows you to transfer a fixed amount from one mutual fund to another, aiding in portfolio rebalancing and risk management.

A Systematic Withdrawal Plan (SWP) allows you to withdraw a fixed amount regularly from your mutual fund, ensuring a steady income while preserving your investment

Assets Under Management (AUM) represents the total market value of assets managed by a mutual fund, reflecting the fund’s size and the trust placed by investors

A lump sum investment is a one-time contribution to a mutual fund, ideal for investors with substantial capital looking for long-term growth.

Units represent your share in a mutual fund. The number of units you own reflects your proportion of the total investment in the fund, determining your entitlement to its returns and growth

A New Fund Offer (NFO) occurs when a mutual fund scheme is launched, allowing investors to buy units at the offer price, typically Rs. 10 per unit. It is as an IPO in the stock market.

An Asset Management Company (AMC) manages mutual funds, handles investment decisions, and undertakes portfolio management to achieve the fund’s objectives.

Net Asset Value (NAV) is the per-unit value of a mutual fund, calculated by dividing the total assets minus liabilities by the total number of outstanding units

The expense ratio is the annual fee, expressed as a percentage, that covers fund management costs. A lower ratio generally leads to higher net returns for investors.

Entry load is a fee charged when investing in a mutual fund. While many funds have removed it, understanding any applicable charges is essential to maximize your investment.

Exit load is a fee charged when redeeming mutual fund units before a specified period. It acts as a penalty for early withdrawal, promoting long-term investment.

Direct mutual funds allow you to invest directly with the fund house, eliminating intermediaries.

Yes, mutual funds offer a great way to diversify and gain exposure to various asset classes. Direct funds can help lower investment costs by eliminating commissions. However, it's crucial to carefully assess your risk profile, financial goals, and other factors before choosing the best mutual funds for your portfolio.

Mutual funds can be profitable in the long run, but their success depends on the quality of fund management and the assets within the fund's portfolio. It's essential to evaluate each mutual fund carefully before making an investment.

Mutual funds attract investors due to diversification and professional management, while stocks appeal to those seeking ownership in a company and potentially higher returns. However, stocks generally require more research and risk management compared to mutual funds.

Mutual funds offer potentially higher returns than FDs but come with higher risk. FDs, on the other hand, provide stability but with lower returns. The choice between the two depends on your risk tolerance and financial goals, rather than one being inherently better than the other.

ETFs trade like stocks, offering greater flexibility, while mutual funds are professionally managed. The choice between ETFs and mutual funds depends on your risk profile, investment style, and financial goals.

The benefits of investing in mutual funds include:

These are the risks of investing in mutual funds:

SIP in mutual funds helps reduce market timing risk and benefits from rupee cost averaging. Lumpsum investments are ideal for those who are confident in timing the market and do not prioritize rupee cost averaging.

The minimum investment amount varies by mutual fund. Some schemes allow investments as low as Rs 100, while others may require higher amounts based on their NAV. Check each fund's NAV on TRIUMPHMFnow.

COMING SOON

Copyright© 2024 TRIUMPHMF | All Rights Reserved | Developed & Manage by NinzaTech Solutions